Sage Pro ERP - Accounts Receivable

The Sage Pro Accounts Receivable module is a complete billing and accounts receivable system with extensive sales analysis reports.

Accounts Receivable delivers incomparable invoice management capabilities, including expert tracking of complete invoice history and highly flexible invoice creation and printing options.

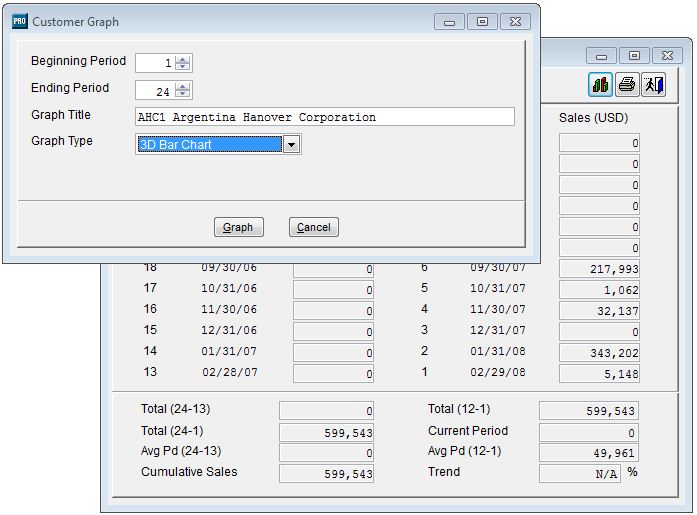

This module instantly displays and prints 24-month customer sales and 36-month item sales histories and graphs, and updates customer and inventory records in real time, providing you with the most current information at all times.

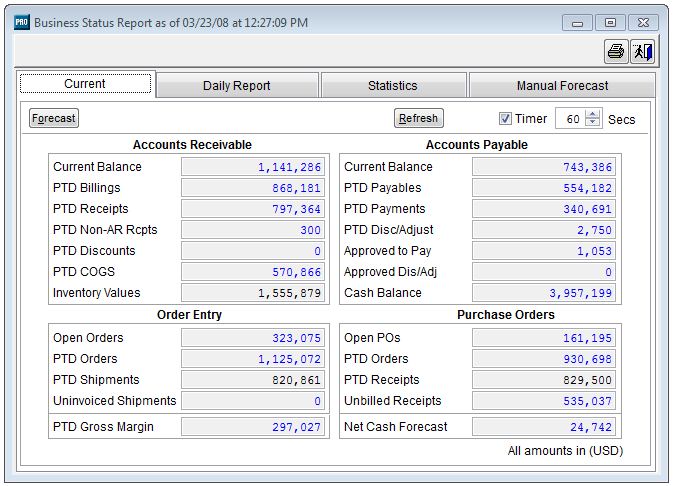

An extensive array of reports is available, including the powerful Real-time Business Status Report, which provides an instant snapshot of many key receivables and inventory indicators.

Phone:

(503) 241-5432

Toll-Free:

(800) 713-3361

Fax:

(800) 948-8891

Email:

info@coatesassociates.com

Features

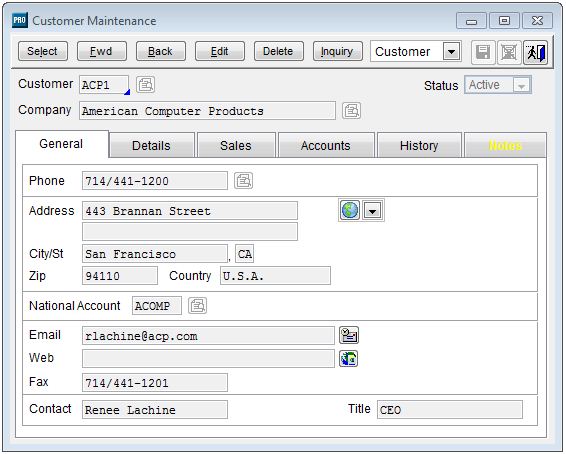

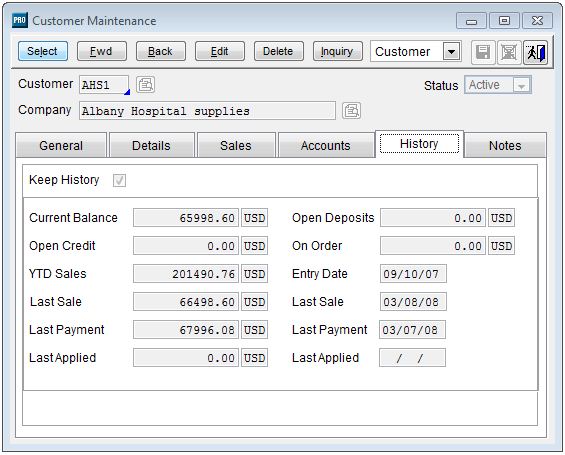

Maintaining Customers

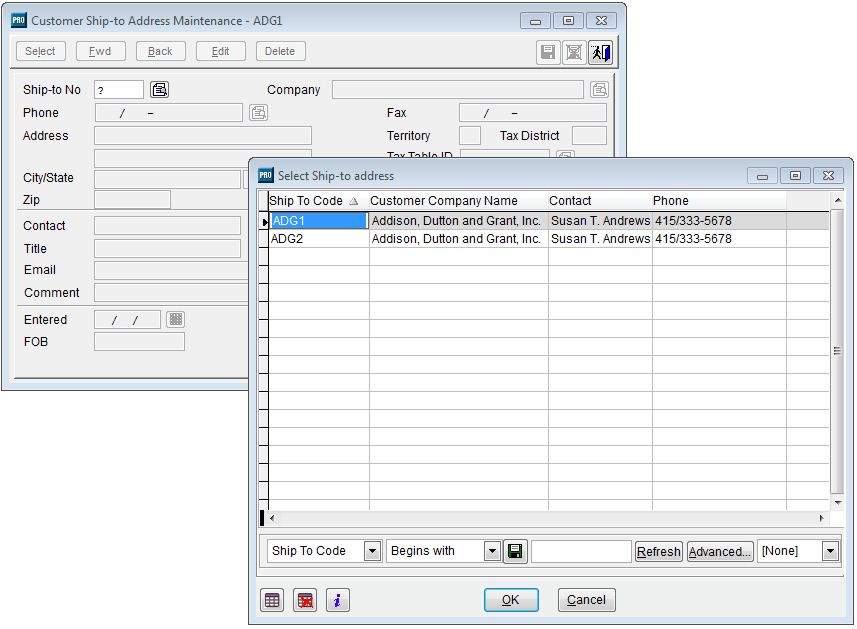

- Supports virtually unlimited ship-to addresses per customer with smart defaults and convenient pop-up pick lists.

- Set up defaults for credit limits, payment terms, and priority in Accounts Receivable setup.

- Customer and vendor merge capabilities.

- User-defined transaction category codes allow you to post transactions to sets of accounts based on both the customer and the item sold, so you can easily report cost and revenue distribution.

- Warns you when a customer's balance exceeds available credit.

- New expanded capabilities have been added to the Customer Payment Terms Maintenance screen.

- New National Accounts functionality has been added to easily manage national account and branch account relationships with customers.

- Customers' records have an Active/Inactive status indicator.

|

|

|

|---|---|---|

| click pictures to view larger images | ||

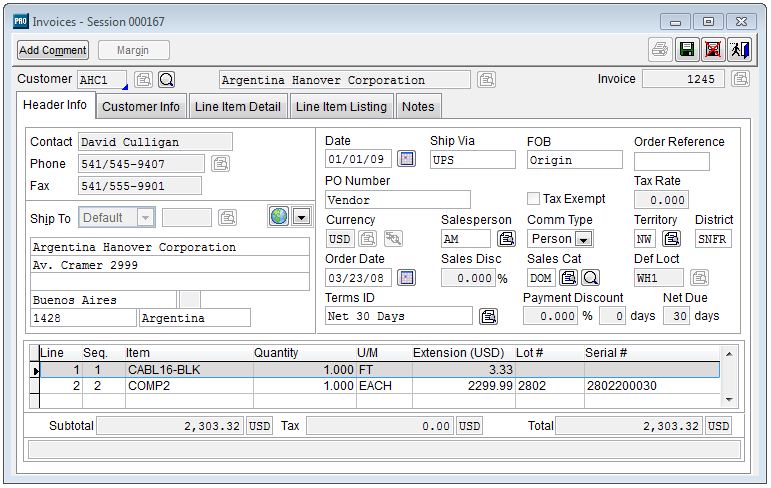

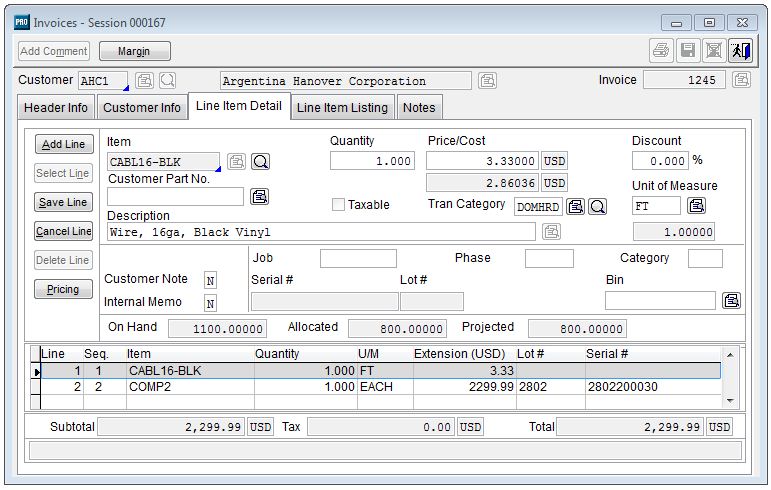

Creating Invoices

- Partial shipments or shipments from selected invoices can be combined into a single invoice.

- New customer or inventory items can be added on the fly during invoicing.

- Companies requiring inventory item-level taxation for Value-Added Tax (VAT) may define as many as 26 different pre-designated tax rates.

- Multiple tax codes can be assigned to a single line item for specialized tax requirements.

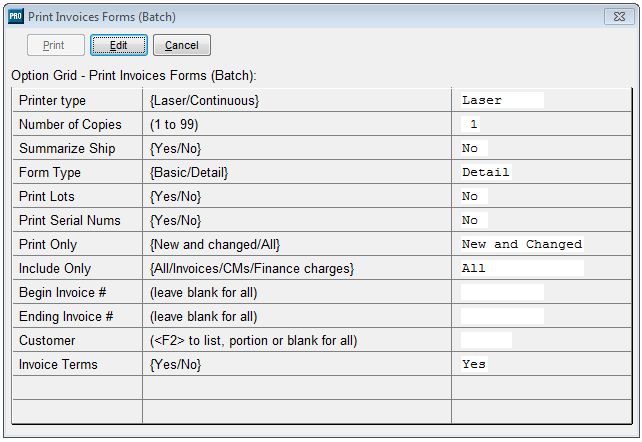

- Prints, faxes, or sends invoices by e-mail in batches or individually.

- Supports data entry in multiple windows at the same time, which enables simultaneous processing of invoices and cash receipts.

- Provides individual printing of invoices for point-of-sale transactions.

- Provides options for recurring billings for services, rental charges, etc.

- Computes and posts finance charges for specified customers.

- Allows viewing of customer or inventory records during transaction entry.

- Generates tax-only credit memos.

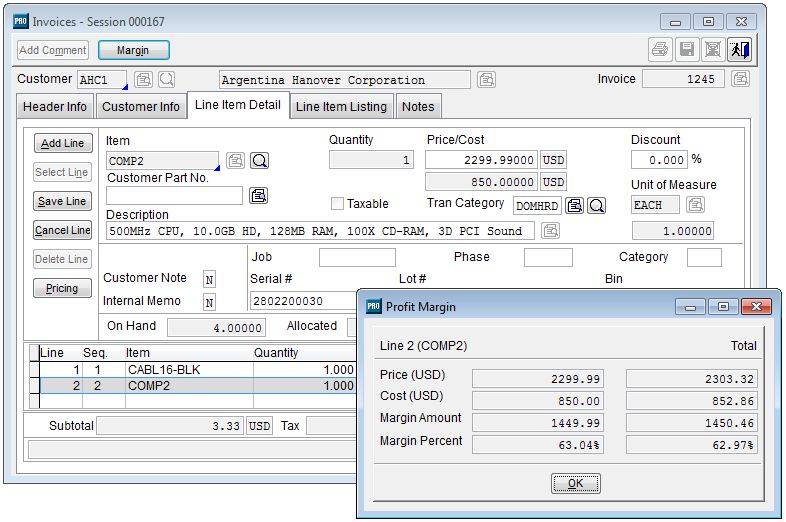

- Cost, price, and margin percentage displays by individual line item or total invoice during Invoice Entry.

|

|

|

|---|---|---|

| click pictures to view larger images | ||

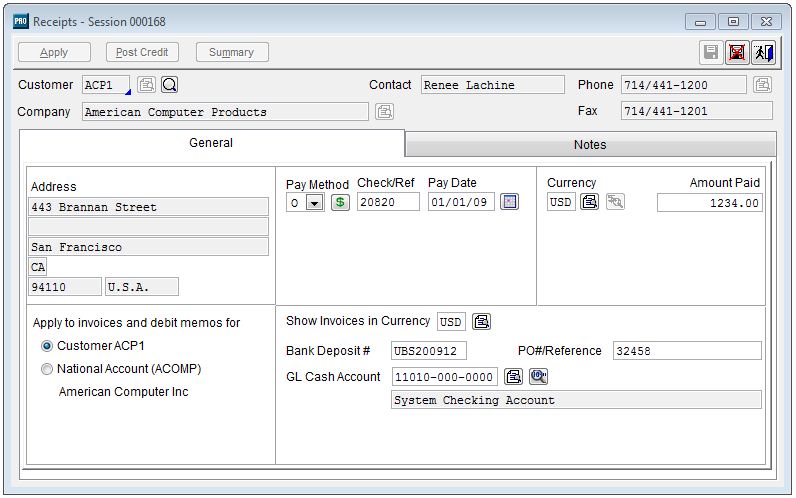

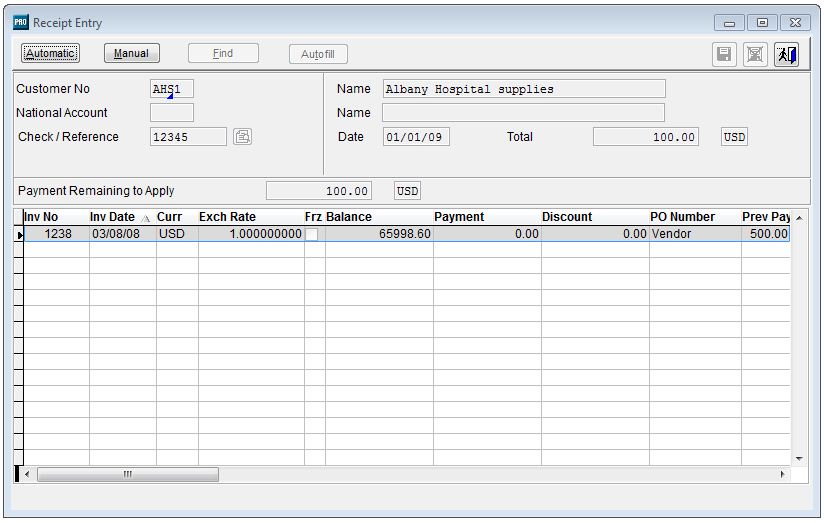

Entering Payment Receipts

- Accepts and tracks non-accounts receivable receipts (e.g., interest paid by bank, tax refund, etc.).

- Create deposits by customers, grouping receipts for easier bank reconciliation.

- Apply credit memos to invoices automatically or manually.

|

|

|

|---|---|---|

| click pictures to view larger images | ||

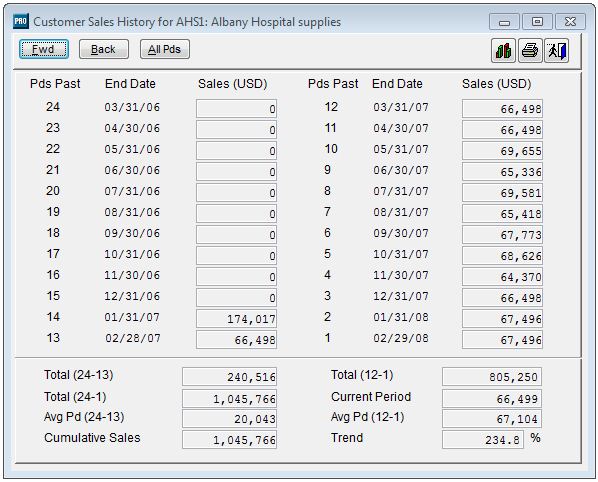

Tracking Customer History

- Tracks complete invoice history for accurate audit trail.

- Displays and prints 24-month customer sales complete with graphs in Microsoft Excel.

- Locates customer records by full or partial phone numbers on pick lists.

|

|

|

|---|---|---|

| click pictures to view larger images | ||

Reporting

- Sales tax can be tracked and reported for multiple tax jurisdictions.

- Create marketing and dunning letters for customers through a DDE link.

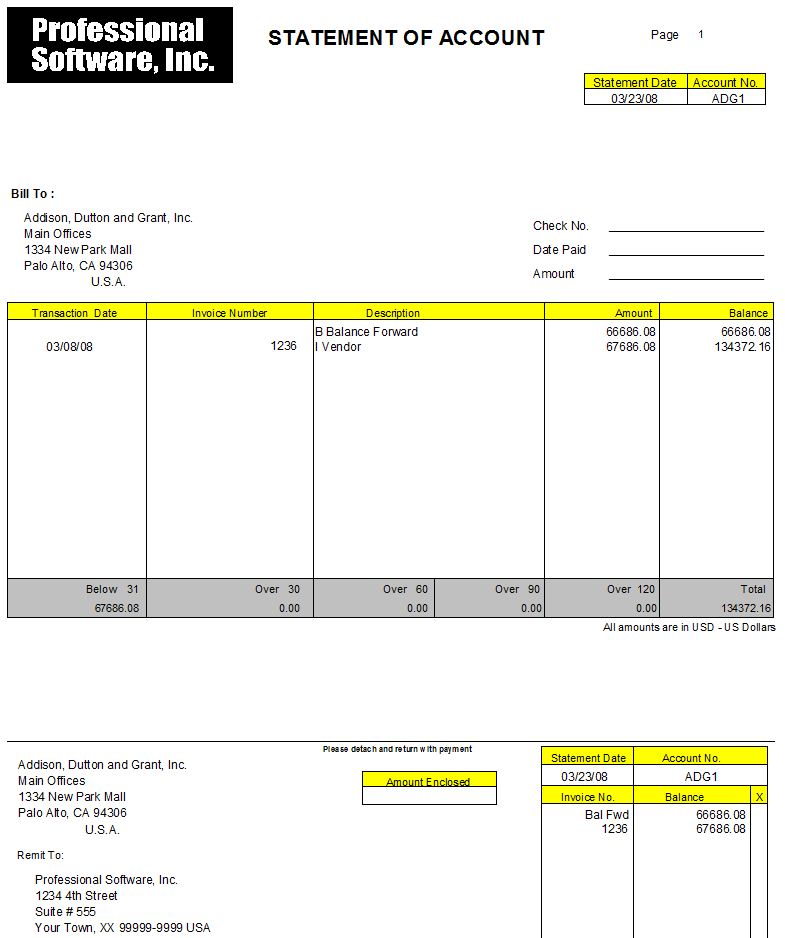

- Statements can either be open item or balance forward-set at the customer level.

- Prints invoices by customer terms, enabling you to mail the most urgent ones quickly.

- Automatic commission (or reversal of commission) generated when saving invoices or credit memos.

- Real-time Business Status Report provides immediate status for current balance, inventory value, period-to-date gross margin, billings, receipts, discounts, and cost of goods sold.

- Provides for user-defined aging of receivables, including the ability to re-create aging reports from prior dates.

|

|

|

|---|---|---|

| click pictures to view larger images | ||

Key Reports

-

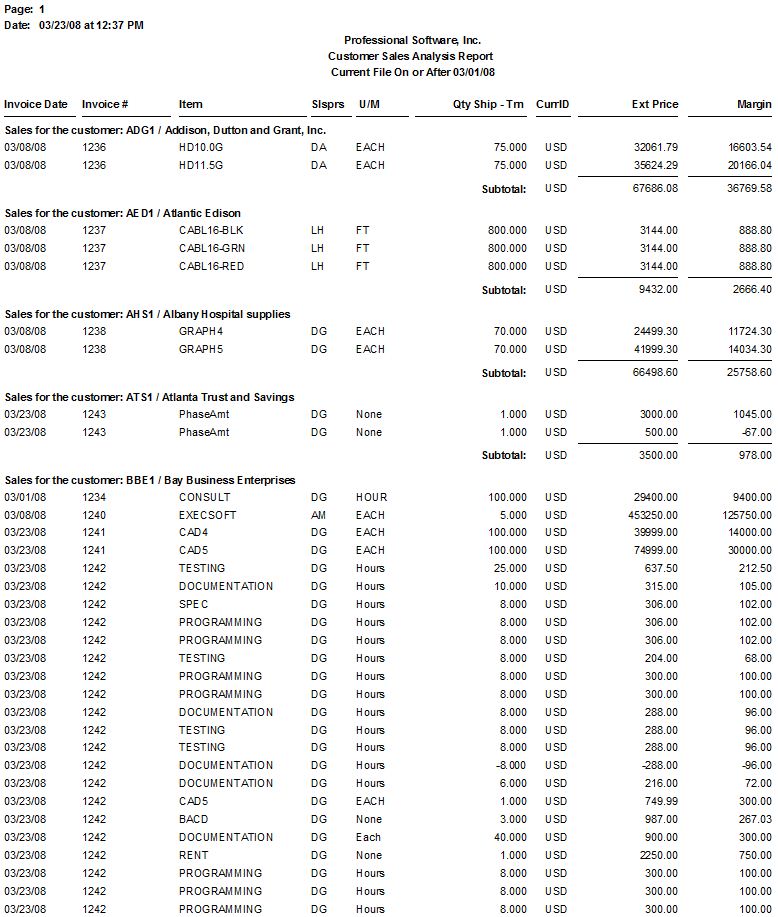

Each report can be customized from a matrix of user-selected options: displayed, printed, exported to a spreadsheet, faxed, sent by

e-mail, or saved on disk. Some of the reports included are:

- Accounts Receivable Journal Report

- Business Status Report

- Cash Receipts

- Credit Applications

- Customer File

- Customer Ledger Listing

- Customer Mailing and Folder Labels

- Customer Statements

- General Ledger Linking Codes

- Inventory File

- Invoice Register

- Invoices

- National Accounts Ledger

- National Accounts Listing

- Open Receivables

- Past Due Items

- Recommended Reorders

- Recurring Billings

- Sales Analysis Report

- Sales Price List

- Sales Tax by Territory

|

|

|

|---|---|---|

| click pictures to view larger images | ||

Click Here to return to the Sage Pro ERP product page